Johannes Eisele/AFP/Getty Images

Good morning and welcome to Insider Finance. I'm Dan DeFrancesco, and here's what's on the agenda today:

- Inside the relationship between law firm Paul Weiss and private-equity giant Apollo Global Management.

- Lenders are looking to artificial intelligence to help with credit decision, but using the tech poses its own risks.

- The burden of bank fees is falling on those least capable of paying them.

We've opened up nominations for our next class of Wall Street rising stars. We want to spotlight the standouts in investment banking, investing as well as sales and trading. Here's how to nominate someone.

Like the newsletter? Hate the newsletter? Feel free to drop me a line at [email protected] or on Twitter @DanDeFrancesco.

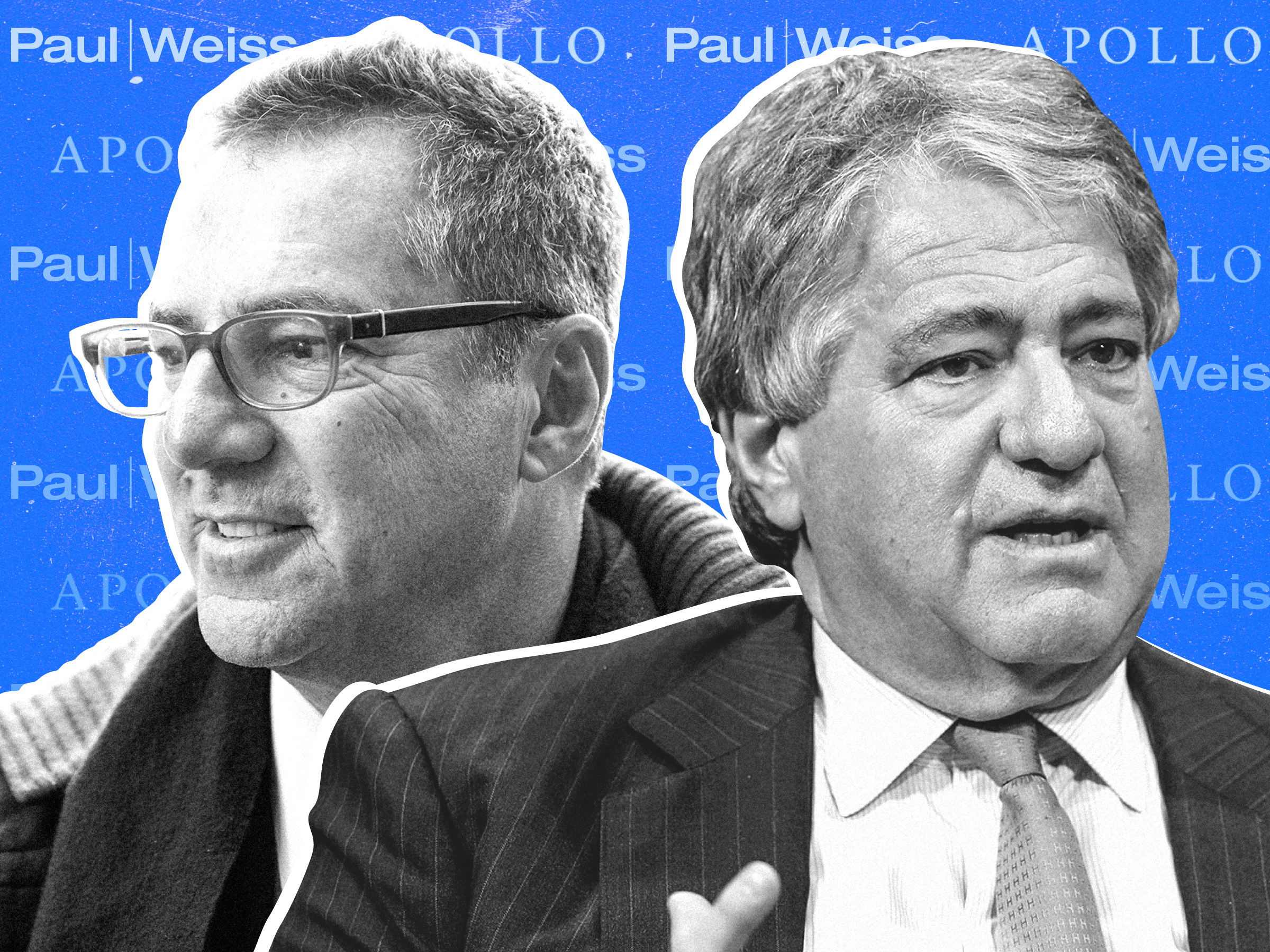

Law firm Paul Weiss' relationship with Apollo has been lucrative. Insiders say it's also sowed tensions within the firm and altered its DNA.

Over the past decade, Paul Weiss has boosted its profits with the help of legal fees from its large private-equity client, Apollo Global Management. The account also changed the law firm's culture, insiders say, and opened it up to criticisms about its independence.

Read more from our exclusive report.

AI can help reduce inequity in credit access, but banks will have to trade off fairness for accuracy - for now

AI-based lenders say that their models can eliminate discrimination, but there are risks to these models - including the quality of the data we feed them. Read the full story here.

Consumers have more banking options than ever before, but few are owned by or designed for underrepresented communities

Of the nation's 5,000 FDIC-insured banks and credit unions, only 3% cater to or are owned by minorities. Get the full rundown here.

Banks earn billions of dollars charging overdrafts fees, and the burden falls on those least able to afford it

Banking fees - particularly overdraft charges - don't affect all Americans equally. In fact, overdraft fees are often paid by those with the lowest balances in their checking accounts. Here's what else you need to know.

Payday lenders target communities of color. But fintechs offering small-dollar loans and flexible wages may help break the debt trap.

Payday lenders target Black and Latinx communities, setting up more stores in minority neighborhoods. Fintechs offering small-dollar loans and early access to wages could prove a replacement for those in need of short-term cash. More on that here.

A top currency investor at $1 trillion Insight Investment breaks down why bitcoin isn't the new gold

Francesca Fornasari explained why bitcoin may not be an effective inflation hedge. Here's what she told us.

Odd lots:

Benchmark's VC Model Strained by Newcomers, Supersize Rivals (The Information)

Nomura Loses 20 Investment Bankers in Asia After Bonus Payouts (Bloomberg)

Lazard Mandates Vaccines, Allows Work From Home Twice a Week (Bloomberg)

Paris gets new JPMorgan trading hub in post-Brexit push (Reuters)

Credit Suisse Weighs Overhaul of Wealth Management Business (Bloomberg)